Starting early and staying invested for a more extended period lets compounding work its magic. Furthermore, it is important to know that mutual fund investments are subject to market risks. Hence, investors should be mindful of the risks and understand the calculator is just an estimate of the potential returns and doesn’t guarantee them.

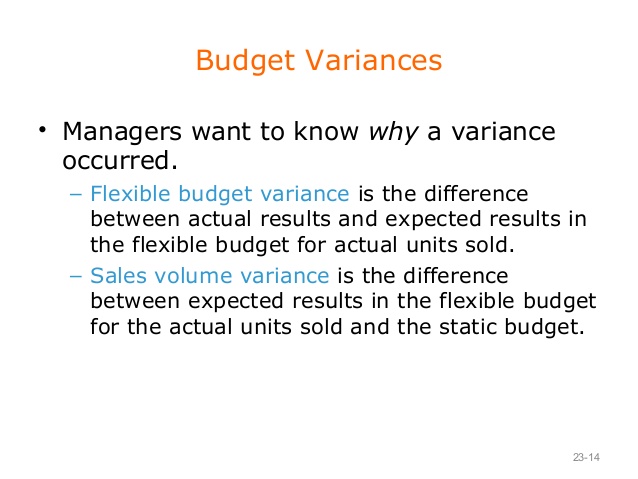

Axis SIP calculator

The results from Navi’s mutual fund SIP calculator could help you plan your investment better by giving you the insights to make any necessary adjustments, if required. For example, you might realise the total value of your SIP investments currently might not be sufficient to meet https://www.quick-bookkeeping.net/state-unemployment-insurance-sui-rates/ your financial goal in time. Thus, you might need to increase the SIP amount or investment tenure or choose another mutual fund that could offer a higher expected return on investment than your present fund. SIP investments are primarily designed for long-term wealth creation.

What are the different types of SIPs?

Now you can decide if this particular amount is correct to invest. Making use of SIP calculator allows individuals to align their investment strategies with their financial goals. It helps them evaluate the impact of varying investment amounts, tenures, and expected returns, enabling them to make adjustments accordingly. By understanding the potential outcomes, investors can make well-informed decisions and set realistic expectations.

What are Systematic Investment Plans (SIPs)?

Mutual Funds also offers tax benefits plans under ELSS (Equity Linked Savings Schemes) with lock-in period of 3 years. SIPs generally don’t have a strict minimum or maximum investment https://www.quick-bookkeeping.net/ period, except for tax-saving/ELSS plans, which typically have a lock-in of 3 years. However, be cautious about potential exit fees if you withdraw before a certain period.

Related Mutual Fund

But your investment must align with the rest of your financial commitments – your income minus existing expenses, liabilities, and loan payment. SIPs can also be categorised as per the kind of instruments that they invest in, e.g. equity funds, debt funds, overnight funds, balanced funds, money market funds, whom may i claim as a dependent etc. The SIP returns are calculated by entering the variable numbers mentioned above into the Systematic Investment Plan calculator. Once you have a clear idea of the expected returns and commitment required, you can then make a more informed decision about which SIP strategy is most viable for you.

All you need to know about Systematic Investment Plan Calculator (SIP)

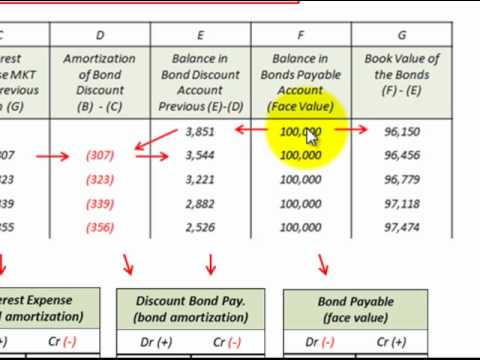

You can start with a modest investment and gradually increase it over time as your income and financial situation improve. This scalability allows investors to align their SIP investments with their evolving financial needs and aspirations. 1) The SIP investment calculator provides you with an overview of how your investments might grow after a certain period of time based on the value of your investments. You can find out approximately how much money you need to invest in Mutual Funds via SIP to earn the desired returns. This allows you to set various short-term, medium-term or long-term goals. While SIPs offer a good measure of potential returns, it is also elemental to understand their tax implications.

SIPs are specially meant for retail investors, who do not have time and resource to follow up the market on daily basis. It’s sole purpose is to save the investors from market volatility by leveraging upon the cost averaging. Any investor is free to stop investing in such plan anytime and increase or decrease the monthly investment.

Apart from offering compounding and rupee cost averaging benefits, SIPs also play a key role in instilling the much-needed investment discipline and regularity among amateur investors. An SIP calculator helps investors to get expected future results based on various factors like invested monetary level, and time of investment. It can calculate results up to a great extent varying upon the condition in expenditure. Potential investors may assume that SIPs and mutual funds are the same. However, SIPs are simply one avenue for investing in mutual funds, with lump-sum investments being an alternative method.

The main difference between SIP & lump sum frequency of investment. In a lump sum investment, you invest a fixed amount of money at one time. In a SIP, you can invest a fixed amount in regular intervals, such as monthly or quarterly. Yes, most mutual fund companies provide the option to pause or temporarily stop your SIP investments for a specified period of time. The investment amount in a SIP can vary based on your financial capacity and the minimum investment requirement specified by the mutual fund scheme. It can range from as low as ₹500 to higher amounts based on your investment goals and the chosen mutual fund.

- Consider factors such as your age, income, financial commitments, and investment experience, to assess your risk appetite.

- As time progresses, the initial investment, along with the accumulated returns, grows at an increasing rate.

- Login to the fund house website, select the SIP you wish to cancel and click on ‘Cancel SIP’.

- Our SIP calculator is a thoroughly tested, and a visually appealing calculator that works with all devices and screen sizes to help you calculate your returns or advise your clients.

This data should be available on yourSIP statement and is regarded as cash inflow rather than outflow. This means that the returns depend upon the performance of the mutual fund you invest in. In the case of one time SIP, you can also follow the similar steps as mentioned above. However, to calculate returns on your lumpsum investment, all you need to do is click on the lumpsum button placed beside the SIP button. SIPs are a beneficial way to grow your corpus for future purposes, and a SIP calculator will help you make the correct investment decision. You can use a SIP calculator and check your strategy accordingly before choosing a plan to invest in.